It's the simple question that goes to the heart of what was wrong with the Coalition's first two budgets: Why was it OK to cut back Family Tax Benefits, but not superannuation tax concessions? What was so different about them that meant a government concerned about the deficit targeted one but not the other?

An immediate answer is that the Coalition promised in the election not to touch super. But the promise only applied to its first term. It also promised not to touch pensions and got around that by announcing changes that would take place only after the next election.

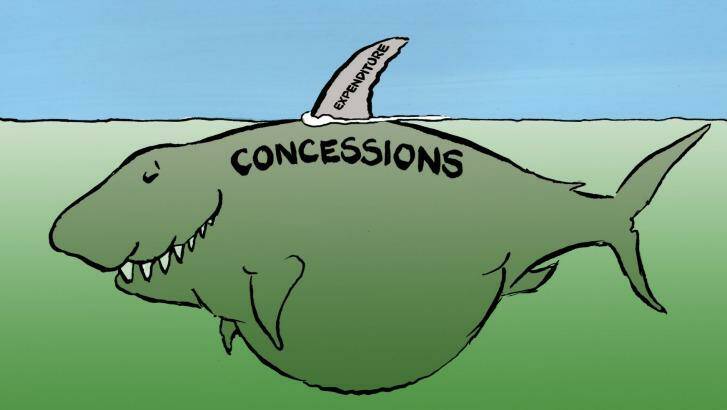

The real answer, or at least the real justification, lies somewhere else. It is that Family Tax Benefits and super tax concessions are different. One costs the government cash. It can be seen in the budget and so it is ripe for cutting. The other is merely a "tax expenditure". It is money the government made sure it never got in the first place.

But the dividing line between the two is far less clear than you might think. The Family Tax Benefit was once a tax concession. Note the use of the word "tax" in its title. Embedded in the tax system as a concession for decades, it was taken out and made an explicit payment by the Fraser government in 1976. Instead of going to the breadwinner (usually the father) it was paid directly to the mother as an allowance - a worthwhile change but one that made it a budget line item, ripe for cutting when the time came.

There's an arbitrariness about which government programs are structured as expenditures and which are structured as tax concessions and turned invisible. In which column does the Private Health Insurance Rebate sit? Try to work it out. I'll tell you at the end of this column.

If the super tax concessions had been turned into explicit payments, doled out each year in the budget so it was obvious who they were going to and how they were increasing, how long would they have lasted? We don't need to guess. We know.

Part of the Gillard government's support for super was delivered as a payment. It was called the Low Income Super Contribution. The Coalition announced plans to axe it in its first budget in 2013 saying it couldn't be afforded. It left the tax breaks available to higher earners untouched. The contribution ends in 2019.

On coming to office in 2007, Labor's Wayne Swan announced plans to set up first home saver accounts that would operate in the same way as super except that instead of the support being delivered as a tax concessions it would be delivered as payments: more for high earners, less for low earners, the same as for super. The plan was ridiculed into oblivion.

"To whom it may concern. I would like to know why an income earner of $180,000+ will receive most contribution from the government while a low to middle-income earner receives the least," was one of the nicer emails the treasury received.

Classify a program as an expense and it'll be subject to rigorous and appropriate scrutiny. Classify another one as a concession and it'll remain off the books, largely unnoticed. Pensions are one of the government's biggest and fastest-growing expenses. But super tax concessions are almost as big and growing more quickly, without the angst.

Grants for public housing are quite rightly examined to see whether they are being put to the best use. But the negative gearing tax concession continues (with government support) even though it no longer funds houses the way it used to. At the turn of the century, 1 in every 6 new investor loans went to build a house. Now it's 1 in 14.

The Howard government's Commission of Audit was on to the double standard. It said tax expenditures were "usually uncapped, open-ended and their costs can rise rapidly". It asked Howard to "comprehensively review all existing tax expenditures". After the review he should "examine the scope to convert remaining tax concessions to outlay programs".

Howard did nothing. Towards the end of its life, his government jaw-droppingly made every dollar earned in the super accounts of retirees over 60 entirely tax-free, taking tax expenditures into new dimension.

Three elections later, the Abbott government's Commission of Audit didn't even examine tax expenditures. Its terms of reference limited it to examining "each dollar spent".

Australia's 25 biggest tax expenditures cost between them $122.2 billion, around one quarter of the Commonwealth budget. The International Monetary Fund says we spend more on them than the USA, more than Britain, more than Greece, more than Italy - more than any of the 16 nations it examined. The Treasury tots them up each year in a Tax Expenditures Statement few people read.

The biggest go to the family home, then to super, the GST and charities. A government genuinely concerned about getting value for money and balancing its budget would impose sunset clauses on the lot then review them portfolio by portfolio over a period of (say) five years. Those that aren't axed it should consider turning into visible grants.

Oh. The Private Health Insurance Rebate is classified as a direct payment. I bet you couldn't work it out and you had to guess.

Peter Martin is economics editor of The Age.

Twitter: @1petermartin

The twenty-four biggest tax expenditures

Capital gains tax main residence exemption - discount component $25.5 billion

Capital gains tax main residence exemption $20.5 billion

Concessional taxation of employer superannuation contributions $16.3 billion

Concessional taxation of superannuation entity earnings $13.4 billion

GST exemption for certain foods $6.4 billion

Capital gains tax discount for individuals and trusts $5.8 billion

GST treatment of financial services $4.45 billion

GST treatment of education $3.95 billion

GST treatment medical and health goods and services $3.55

Concessional taxation of non-super termination benefits $2.7 billion

Tax exemption for Family Tax Benefit payments $2.22

Statutory effective life caps for writing off assets $1.945 billion

Exemption from interest withholding tax on certain securities $1.86

Medicare levy exemption for residents with low taxable incomes $1.71

Tax exemption of the Private Health Insurance Rebate $1.57

Exemption for public & not-for-profit ambulance and hospitals $1.4 billion

Exemption for other public benevolent institutions $1.36 billion

Concessional excise for aviation gasoline and turbine fuel $1.23 billion

GST exemption for residential and community care services $1.11 billion

Tax deduction for gifts to registered charities $1.1 billion

GST exemption for child care services $1.09 billion

Non-refundable research and development tax offset $1.07 billion

GST exemption for water, sewerage and drainage $1.05 tax billion

Tax deduction for capital works $960 million